Table Of Contents

What is Ledger in Accounting?

Ledger in accounting records and processes a firm’s financial data, taken from journal entries. This becomes an important financial record for future reference. It is used for creating financial statements. It is also known as the second book of entry.

The entries are used to formulate a company's trial balance, income statement, and balance sheet. This secondary book of account is categorized into assets, liabilities, revenue, expenses, and equity. Thus, the second book of entry systematically displays all transactional information associated with a particular account.

Table of contents

- The ledger in accounting records journal entries from separate accounts in a chronological manner. It is maintained in a T format. For closing balance, It shows a debit or credit balance—at the end accounting period.

- All ledger balances are transferred to the trial balance. Ledgers contain important data— income statements and balance sheets are formulated based on that information.

- The second book of the entry contains eight columns—four on the debit side and four on the credit side—Date, Particulars, Reference Number, and Amount.

Ledger in Accounting Explained

A ledger is a date-wise record of all the transactions related to a particular account. Ledgers are also called the secondary book of accounts or the second book of entry. It is represented in a tabular double-entry system consisting of the debit and credit sides. Account balance is the debit or credit surplus from the transactions pertaining to a particular account. The balance is acquired at the end of an accounting period and transferred to the company's trial balance.

Ledgers are crucial sources of financial records. An organization initially records every financial transaction in a journal. The next step involves classifying journal entries into separate accounts and posting them in the ledger—cash account, salary account, and payables account.

The creation of a ledger involves the following steps:

- Approve all the journal entries and tally them for accuracy.

- Formulate a format by drawing debit and credit sides—modern format divides debit and credit sides further into four or three columns.

- Label each of these four columns—Date, Particulars, Reference Number, and Amount.

- Now, post every journal entry into individual ledger accounts.

- At the end of the accounting year, calculate the final balance of every ledger account.

Ledger balancing assists in computing how much assets, liabilities, or revenue is left with the firm at the end of the year. Using this computation, an organization prepares its financial statements. Many accounting software is used for maintaining books of accounts.

There is a key difference between a journal and a ledger. A journal is the first step of financial reporting—all the accounting transactions are analyzed and recorded as journal entries. In contrast, the ledger is the extension of the journal. Journal entries are recorded by the company in its general ledger.

Ledger in Accounting Video

Format

Ledgers have a T format where the debit is depicted on the left side, and credit is shown on the right side. Each side has four columns: date, particulars, reference number, and amount. New formats do not include reference number columns.

The template of a ledger is as follows:

Dr. Cr.

| Date | Particulars | R | Amount | Date | Particulars | R | Amount |

The book of accounts has two sides:

- Debit Side: The debit side of an account represents all the debit increases.

- Credit Side: This side shows all the credit increases of the account.

Different ledger columns are as follows:

- Date: The date of executing a particular transaction.

- Particulars: The contra account of the concerned account in the double-entry system.

- Reference Number (R): It comprises the serial number of the journal entry. The number is mentioned in ledgers—journal folio.

- Amount: It is the amount debited or credited to the particular account during the transaction.

Example

Let us assume LMN Ltd. approves the following journal entries for the year ending on December 31, 2021:

- Machinery purchased for $17000 through cheque—January 1, 2021.

- Goods sold for $1950—March 18, 2021.

- Goods sold to XYZ Ltd. for $3600—May 20, 2021.

- Depreciation on machinery charged $1700—December 31, 2021.

Solution:

Journal Entries in the Books of LMN Ltd. for the year ending December 31, 2021:

| S.N. | Date | Particulars | Dr. ($) | Cr. ($) |

|---|---|---|---|---|

| 1 | 01/01/21 | Machinery A/c …. Dr. To Bank A/c | 17000 | - 17000 |

| 2 | 18/03/21 | Cash A/c …. Dr To Sales A/c | 1950 | - 1950 |

| 3 | 20/05/21 | XYZ Ltd. A/c …. Dr To Sales A/c | 3600 | - 3600 |

| 4 | 31/12/21 | Depreciation A/c …. Dr To Machinery A/c | 1700 | - 1700 |

LMN Ltd. Ledger for the year ending December 31, 2021:

Machinery A/c

Dr. Cr.

| Date | Particulars | R | Amount ($) | Date | Particulars | R | Amount ($) |

|---|---|---|---|---|---|---|---|

| 01/01/21 | To Bank A/c | 1 | 17000 | 31/12/21 | By Depreciation A/c | 4 | 1700 |

Bank A/c

Dr. Cr.

| Date | Particulars | R | Amount ($) | Date | Particulars | R | Amount ($) |

|---|---|---|---|---|---|---|---|

| 01/01/21 | By Machinery A/c | 1 | 17000 |

Cash A/c

Dr. Cr.

| Date | Particulars | R | Amount ($) | Date | Particulars | R | Amount ($) |

|---|---|---|---|---|---|---|---|

| 18/03/21 | To Sales A/c | 2 | 1950 |

Sales A/c

Dr. Cr.

| Date | Particulars | R | Amount ($) | Date | Particulars | R | Amount ($) |

|---|---|---|---|---|---|---|---|

| 18/03/21 20/05/21 | By Cash A/c By XYZ Ltd. A/c | 2 3 | 1950 3600 |

XYZ Ltd. A/c

Dr. Cr.

| Date | Particulars | R | Amount ($) | Date | Particulars | R | Amount ($) |

|---|---|---|---|---|---|---|---|

| 20/05/21 | To Sales A/c | 3 | 3600 |

Depreciation A/c

Dr. Cr.

| Date | Particulars | R | Amount ($) | Date | Particulars | R | Amount ($) |

|---|---|---|---|---|---|---|---|

| 31/12/21 | To Machinery A/c | 4 | 1700 |

Types

Given below are the three types of ledgers maintained by a business entity:

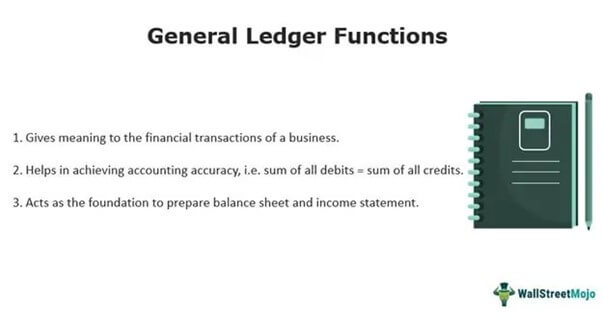

#1 - General Ledger

It is a collection of all the ledger accounts made during a certain period. It records various financial transactions of the business in separate accounts—assets, liabilities, revenues, expenses, and shareholders' equity. It is categorized as follows:

- Private Ledger: It is the restricted set of confidential accounts and can be accessed by very few people—capital accounts, goodwill accounts, etc.

- Nominal Ledger: It includes accounts related to income, expenses, losses, and gains—rent, salary, interest on loans, etc.

#2 - Purchase Ledger

It specifically records high-value transactions which involve suppliers. Therefore, it represents the overall outstanding amount payable to a supplier. However, for low purchase volumes, entries can be made to the general book of accounts instead of the purchase book of accounts.

#3 - Sales Ledger

A sales ledger keeps a record of all credit sales transactions made by customers. It shows individual accounts of each customer.

Frequently Asked Questions (FAQs)

First, approve the journal entries by eliminating errors. Then create a format comprising all the accounts mentioned in the journal. Next, record each journal entry in the relevant ledger. Finally, find the balance for each account.

A cash book is both a journal and a ledger. Cash transactions are first entered into a cash book; then, it is recorded into the respective ledger— it acts as a journal. However, as it provides the closing cash balance at the end of the accounting period, it can also be used as the second book of entry.

Companies prepare three kinds of ledger:

1. General ledger

2. Sales ledger

3. Purchase ledger

Recommended Articles

This article has been a guide to what is Ledger in Accounting. Here is a tutorial on how to make & format ledger in accounting books/software along with its types. You may also have a look at other basic accounting articles -